The U.S. economy is currently facing a challenging scenario marked by escalating tensions and uncertainty. Recent developments, such as the trade war impact from tariffs imposed by countries like China, Mexico, and Canada, have raised recession fears among economists and investors alike. With the University of Michigan’s consumer sentiment index reflecting plummeting confidence, discussions at the Federal Reserve are becoming increasingly critical as they evaluate interest rates to stabilize economic growth. Predictions suggest a turbulent period ahead, where the balance between stimulating growth and curbing inflation remains delicate. As all eyes turn toward monetary policy adjustments, the trajectory of the U.S. economy is becoming more unpredictable.

The current financial landscape in the United States is fraught with apprehensions as analysts weigh the implications of recent policy shifts. As trade tensions escalate due to tariff disputes, broader economic indicators are starting to signal potential downturns, creating a climate of uncertainty for future fiscal viability. With consumer confidence waning and employment trends showing signs of slowing, many are questioning whether the nation faces a period of stagnation akin to the challenges seen in the past. The negotiations surrounding interest rates by the Federal Reserve will play a crucial role in steering the economic ship amid these turbulent waters. A comprehensive understanding of these dynamics is essential for predicting how the nation’s financial outlook may evolve in the months to come.

The Rising Concerns Over the U.S. Economy

As the U.S. economy navigates turbulent waters, multiple factors are raising red flags among analysts and investors. The ongoing trade war has instigated a ripple effect throughout the markets, significantly impacting consumer sentiment. With the University of Michigan’s consumer sentiment index dropping to its lowest point since late 2022, many are questioning the resilience of the American economic landscape. This decline in confidence is posing questions about future spending patterns, which are vital for sustained economic growth.

Moreover, the apprehension surrounding potential recessionary pressures is palpable. With heightened trade tensions coupled with a volatile stock market, the aggregate risk perception among consumers and investors has intensified. This scenario could lead not only to a slowdown in economic growth predictions but also potential stagflation akin to what was observed in the 1970s, underscoring the urgent need for sound economic policies.

Impact of Trade War on Economic Sentiment

The ramifications of the trade war initiated by the current administration cannot be overstated. As tariffs are imposed on goods from countries like China, Mexico, and Canada, the costs are inevitably passed down to consumers. This shift not only diminishes disposable income but also rattles consumer sentiment, which is a crucial driver for the U.S. economy. The decline in consumer sentiment indicates a potential decrease in spending, which, if sustained, could lead to significant repercussions on economic growth.

Additionally, the uncertainty surrounding trade policies has led to a hesitant investment climate. Businesses are increasingly cautious about committing to new projects or expanding operations, fearing that the trade landscape may shift drastically. This stalling of investments could impair productivity gains, further slowing down economic momentum and making the prospect of a recession more realistic.

Federal Reserve’s Dilemma: Interest Rates and Economic Growth

The Federal Reserve is currently at a crossroads, where it must balance the conflicting demands of supporting economic growth while controlling inflation. With consumer fears heightened and economic confidence low, there is a strong case for reducing interest rates to spur spending and investment. However, increasing rates could be seen as necessary to combat rising inflation expectations stemming from the trade war and supply chain disruptions.

This dilemma is further complicated by external shocks, much like those seen during previous economic crises. The Fed’s response in the coming months will be pivotal in shaping the trajectory of the U.S. economy. Maintaining the current interest rate could stabilize inflation but may also stifle growth, accentuating recession fears among investors and consumers alike.

Consumer Sentiment: A Snapshot of U.S. Economic Health

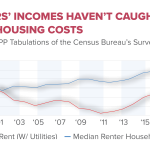

Consumer sentiment serves as a barometer for the overall health of the U.S. economy, and recent trends are concerning. As reported, the University of Michigan’s index has plummeted, indicating that consumers are increasingly wary of their financial futures. This decline mirrors apprehension about job security, income growth, and overall economic stability, all of which are critical for a robust economy.

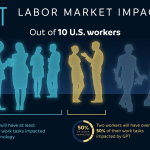

Consequently, negative consumer sentiment not only affects personal spending but also has a domino effect on business investment and hiring practices. Companies often rely on consumer confidence to guide their business strategies, and a lack of confidence can lead to hiring freezes or cuts, which ultimately amplifies the risks of entering a recession.

Predictions on Economic Growth Amidst Current Challenges

Looking ahead, economists are working diligently to formulate realistic predictions on economic growth in the face of mounting challenges. The interplay between the trade war, shifts in consumer sentiment, and the Federal Reserve’s responses will dictate the trajectory of recovery. Many fear that without proactive measures, we may find ourselves in a stagnant economy, reminiscent of the stagflation period of the 1970s.

However, some analysts remain cautiously optimistic, suggesting that resolving trade disputes and stabilizing policies could reignite economic momentum. If consumer confidence improves and strategic investments are made, the U.S. economy could see potential for a rebound. Nevertheless, the uncertainty surrounding these factors makes concrete predictions increasingly complex.

The Effects of Inflation on Consumer Behavior

Inflation, particularly in the current economic climate, is a pressing concern for many American consumers. Rising prices due to tariffs and supply chain issues mean that consumers are not only spending more but also potentially saving less. This dynamic shifts consumer behavior significantly, prompting a more cautious approach to spending as individuals prioritize essential purchases over discretionary spending.

Moreover, the anxieties surrounding inflation can have long-lasting effects on economic recovery. As consumers adapt their spending habits in reaction to rising costs, businesses must pivot to meet these changing demands. The need for businesses to adjust pricing strategies and product offerings could hinder overall economic growth, leading to a cycle of stagnation that could exacerbate recessionary fears.

Navigating Economic Uncertainty: Business Strategies

In the face of growing economic uncertainty, businesses must be proactive in their strategies to mitigate risks. Many companies are adopting a wait-and-see approach, pausing on major investments and hiring decisions until there is clearer visibility into the economic outlook. This caution, while prudent, can also stifle growth and innovation if prolonged.

To navigate this uncertainty, businesses are increasingly focusing on efficiency and adaptability. Strategies such as diversifying supply chains, enhancing operational flexibility, and investing in technology could provide competitive advantages. By remaining agile, businesses can position themselves favorably regardless of subsequent economic developments.

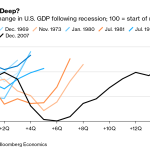

Recession Fears: Historical Context and Future Outlook

Understanding the current climate requires a look back at historical precedents. The 2008 financial crisis serves as a reminder of how quickly economic sentiment can shift from optimism to pessimism. Current recession fears echo those sentiments, reigniting discussions about fiscal policies and market resilience that were prominent during past downturns.

However, learning from the past also provides an opportunity for informed decision-making. Economists emphasize the importance of swift policy interventions, transparent communication, and coordinated responses to stabilize markets and bolster confidence. The future of the U.S. economy hinges not only on overcoming current challenges but also on applying lessons learned from previous economic downturns.

Tariffs and Their Long-Term Economic Implications

The long-term implications of tariffs remain a contested topic within economic circles. While some argue that tariffs can protect nascent industries, many economists contend that they ultimately lead to inefficiencies and increased costs for consumers. As the trade war escalates, the long-term health of the U.S. economy will greatly depend on how these tariffs are managed and their permanence.

As businesses adapt to these tariffs, industries that rely heavily on imports may be particularly vulnerable. Supply chain disruptions and passing costs onto consumers could hinder competitiveness in the global market. The long-term impact of current tariff policies could thus redefine the landscape of American industries, shaping the economic trajectory for years to come.

Frequently Asked Questions

What is the impact of the trade war on the U.S. economy?

The ongoing trade war, particularly with major trading partners like China, Mexico, and Canada, has raised significant concerns regarding the U.S. economy. Investors fear that it could lead to a recession due to increased tariffs on American goods, resulting in heavy losses in the stock market and weakened consumer sentiment.

Are recession fears justified in the context of the U.S. economy?

Yes, recession fears are currently justified as multiple factors suggest a possible downturn. Recent declines in consumer sentiment, stock market volatility, and the effects of prolonged trade conflicts have heightened worries about a recession occurring within the next year.

How are Federal Reserve interest rates affecting the U.S. economy?

The Federal Reserve’s interest rate decisions play a crucial role in shaping the U.S. economy. Currently, the Fed faces a dilemma between cutting rates to stimulate economic growth and maintaining them to control inflation. The uncertainty surrounding tariffs and trade policies complicates this decision, impacting overall economic stability.

What do current consumer sentiment trends indicate about the U.S. economy?

The latest consumer sentiment index reflects the lowest confidence levels since late 2022, indicating that Americans are increasingly worried about economic prospects. This decline signals potential challenges for the U.S. economy as lower consumer confidence often translates to reduced spending and slower economic growth.

What are the economic growth predictions for the U.S. economy amid current challenges?

Economic growth predictions for the U.S. economy are becoming more cautious due to the trade war, reduced consumer sentiment, and increased risk perceptions. Analysts suggest that these factors could significantly hinder growth, potentially leading to a recession if conditions do not improve.

| Key Point | Details |

|---|---|

| U.S. Economy Concerns | The U.S. economy is experiencing significant challenges, particularly due to trade tensions and a potential recession. |

| Impact of Tariffs | Tariffs imposed by other countries in retaliation to U.S. policies are impacting American goods and investor confidence. |

| Consumer Sentiment | The University of Michigan’s consumer sentiment index has dropped, indicating decreased economic confidence among consumers. |

| Federal Reserve’s Dilemma | The Federal Reserve faces a tough decision on whether to cut interest rates to stimulate the economy or maintain them to control inflation. |

| Risk of Recession | Analysts warn of a significant risk of recession within the next year due to trade wars, market instability, and reduced consumer confidence. |

Summary

The U.S. economy is currently at a crossroads, facing challenges from trade disputes and decreasing consumer confidence. As tariffs continue to strain relations with trading partners like China, Mexico, and Canada, there are increasing fears that these tensions could lead to a prolonged recession. Market analysts are expressing heightened concern regarding the implications of a potential economic slowdown, which could further reduce employment rates and income stability. With the Federal Reserve weighing significant policy decisions, the outlook for the U.S. economy remains precarious, highlighting the urgency for effective economic strategies moving forward.