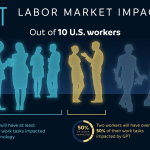

Research funding impact is crucial for the advancement of innovation and entrepreneurship growth in the U.S. economy. As institutions like Harvard face significant cuts and freezes to their federal funding for scientific research, the ripple effects could threaten the very foundation of the startup ecosystem. Economists warn that reduced financing for research can lead to a decline in gross domestic product, reminiscent of economic downturns such as the 2008 Great Recession. The vibrant relationship between research universities and emerging startups is vital for fostering new ideas and technological advancements that drive economic progress. Without adequate funding, the pipeline of innovation may dwindle, ultimately stifling the entrepreneurial spirit that underpins U.S. leadership in technological discoveries.

The implications of funding for scientific inquiry extend far beyond mere financial support; they are pivotal in catalyzing growth within the entrepreneurial landscape. When universities, such as those at Harvard, experience interruptions to their federal grants, critical research efforts that fuel startup creation and innovation in America are at risk. Academic institutions serve as incubators, nurturing groundbreaking concepts that eventually lead to commercially viable businesses. Without sustained investment from government bodies, the vital connection between academic research and entrepreneurship could falter, impeding the continuous development of new technologies and problem-solving ventures. Therefore, understanding the dynamics of funding in this context is essential for grasping the broader implications for U.S. economic resilience and growth.

The Role of Research Universities in Startup Innovation

Research universities like Harvard serve as pivotal hubs for innovation, linking faculty research to entrepreneurial endeavors. The unique intersection of academia and industry drives the development of groundbreaking technologies and startups. Faculty members engage in cutting-edge research, particularly in fields such as computer science and biomedical engineering, producing ideas that have the potential for commercialization. Incubators within these institutions, such as the Wyss Institute, foster an environment where scientific discoveries can transition from academic papers to market-ready products, forming the backbone of the U.S. startup ecosystem.

Moreover, students contribute significantly to this dynamic environment. With robust entrepreneurship programs and access to seasoned experts and mentors, students are uniquely positioned to launch startups. Initiatives like the Harvard Innovation Labs amplify this effect, creating a rich tapestry of entrepreneurial activity. As these students and faculty collaborate, the synergy between research and startup creation enhances the potential for innovation, demonstrating how critical research universities are to the broader entrepreneurial landscape.

Impact of Research Funding on U.S. Economic Growth

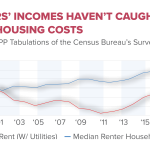

Federal funding plays a crucial role in sustaining research initiatives that drive economic growth. Historical data shows that every dollar invested in biomedical research returns about $2.56 in economic activity, illustrating a strong correlation between research funding and GDP growth. This influx of resources fuels not only the creation of new technologies and startups but also enhances the overall competency of the workforce by attracting top talent from around the globe. As research labs become increasingly well-funded, they produce high-quality work that drives innovation and supports advancements in various sectors.

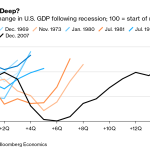

However, cuts to research funding present a significant threat to this economic ecosystem. As highlighted in recent analyses, even a temporary freeze on funding can lead to substantial setbacks in startup formation and scientific breakthroughs. The potential shrinkage of the GDP by 3.8 percent serves as a stark warning that diminished investment in research can stifle entrepreneurship growth, disrupt technological advancements, and ultimately hinder U.S. competitiveness on a global scale.

Navigating Federal Funding Challenges

The current climate surrounding federal funding presents unique challenges for research universities and their related startups. With over $9 billion in grants under review, institutions like Harvard must navigate restrictions while advocating for their funding needs. This precarious situation may lead to hiring freezes and canceled research initiatives, amplifying the risk for emerging entrepreneurs who rely heavily on academic partnerships and innovation centers for their development. Understanding the dynamics of federal funding is critical for universities that wish to retain their status as leading incubators of startup innovation.

Moreover, the role of faculty and students in combating these funding challenges cannot be underestimated. By leveraging their networks and expertise, they can advocate for policies that support sustained investment in research and development. As panel discussions and workshops become more common in these institutions, the call to action for innovation in U.S. technology sectors remains strong, emphasizing the need for unity in addressing funding issues that threaten the entrepreneurial ecosystem.

Harvard’s Response to Funding Freeze

In response to the government’s funding freeze, Harvard has taken an assertive stance, initiating a lawsuit to challenge the restrictions on its grants. This legal response reflects the desperation and determination of educational institutions facing unprecedented challenges to their research capabilities. Harvard’s position highlights the critical intersection of academic freedom and financial support, underscoring the vital nature of unrestricted access to research funding for the continued growth of entrepreneurship and innovation.

Additionally, this legal maneuver underscores the disruption not just for Harvard, but for the larger startup ecosystem reliant on fresh ideas emerging from scientific research. With potential losses translating into fewer startups and innovations, this case serves as a bellwether for the future of research funding across the country — a situation that could reshape the entrepreneurship landscape of the U.S. for years to come.

The Future of Entrepreneurship Amid Funding Cuts

The implications of funding cuts on the future of entrepreneurship are profound and multi-faceted. Economic projections suggest a troubling decrease in the number of startups emerging from cutting-edge research environments. As labs scale back their operations and prioritize essential projects due to funding uncertainties, aspiring entrepreneurs might find their creative pathways significantly narrowing. It underscores the importance of advocating for stable federal funding as a requisite for nurturing the next generation of innovators.

In the long run, the effectiveness of recovery measures taken by universities and policymakers will dictate the trajectory of startups across the nation. Initiatives aimed at fostering entrepreneurship must be resilient in the face of funding fluctuations. By creating alternative funding mechanisms and fostering partnerships across sectors, U.S. universities can mitigate the long-term repercussions of funding disruptions and continue to serve as engines for innovation and economic growth.

Collaboration Between Academia and Industry

The collaboration between academic institutions and industries fuels the startup ecosystem by promoting the translation of research outcomes into viable business models. Research universities often collaborate with corporations, venture capital firms, and nonprofits, bridging the gap between theoretical knowledge and practical application. This partnership not only enhances the commercialization process but also fosters an environment ripe for innovation and entrepreneurship.

Such partnerships facilitate knowledge exchange, enabling students and faculty to gain insights from industry practices while companies benefit from cutting-edge research. As students engage in real-world projects, they develop the skills and experiences needed to launch successful startups, reinforcing the importance of collaboration in driving entrepreneurship growth within the U.S. startup landscape.

The Magnet Effect of Top Research Institutions

Top research institutions like Harvard operate as magnets for talent, attracting bright individuals from around the world. These institutions offer a fertile environment for innovation, equipping students and researchers with unparalleled resources and expertise. The allure of working alongside leading academics and entrepreneurs creates a thriving culture of exploration and idea generation, essential for the growth of startups.

This magnet effect extends beyond individual careers to bolster the broader startup ecosystem. When cutting-edge research results in technological advances, the potential for commercial success attracts angel investors and venture capitalists eager to fund the next big idea. Thus, the presence of world-class research institutions serves as a crucial pillar supporting entrepreneurship and innovation in the U.S. economy.

Long-term Effects of Funding Disruptions

The long-term consequences of funding disruptions could echo throughout the startup ecosystem for years to come. As the pipeline for innovation becomes constrained, the flow of new ideas may diminish, leading to a slowdown in the creation of transformative companies. Entrepreneurs who rely on lab-based research for inspiration may find themselves lacking the resources necessary to launch new ventures, ultimately stymying technological advancements.

Moreover, as fewer startups enter the market, existing companies may face increased pressure as competition wanes, leading to less innovation overall. The landscape of American entrepreneurship could fundamentally shift, highlighting the critical need for sustained investment in research funding to foster a vibrant entrepreneurial climate that propels U.S. economic growth.

Strategies for Resilient Startup Ecosystems

Building resilience within the startup ecosystem requires a multifaceted approach that includes securing diversified funding sources, fostering community partnerships, and promoting an agile structure within research institutions. By establishing alternative revenue streams and collaborative models, startups can weather the unpredictability of federal funding. Engaging in joint ventures with industry stakeholders not only provides additional funding opportunities but also fortifies the connection between academic research and market needs.

Furthermore, creating spaces for dialogue between entrepreneurs, researchers, and policymakers can ensure that the needs and challenges of the startup community are addressed proactively. By fostering an inclusive and innovative environment, the startup ecosystem can adapt to changes in funding landscapes and continue to thrive, driving economic growth and societal advancements.

Frequently Asked Questions

What is the impact of federal funding on the startup ecosystem and entrepreneurship growth in the U.S.?

Federal funding plays a critical role in the startup ecosystem by enabling research universities to innovate and incubate new ideas. With adequate funding, labs can produce groundbreaking research that leads to the creation of startups and enhances entrepreneurship growth. Lack of funding can stifle innovation, limiting the number of successful startups emerging from universities.

How does the rejection of government research funding affect Harvard’s role in the startup ecosystem?

The rejection of government research funding threatens Harvard’s ability to innovate, potentially reducing the university’s contributions to the startup ecosystem. With over $2 billion in grants frozen, the potential for cutting-edge research that can lead to new startups diminishes, impacting entrepreneurship growth in the larger U.S. economy.

In what ways does research funding impact innovation in the U.S.?

Research funding significantly impacts innovation in the U.S. by providing the resources necessary for labs and universities to conduct valuable research. This funding fuels development of new technologies and ideas that can be commercialized, driving economic growth and maintaining the competitive edge of the U.S. in global markets.

How has the funding freeze affected the future of startups and entrepreneurship at research institutions like Harvard?

The funding freeze has immediate and long-term implications for startups and entrepreneurship at research institutions like Harvard. The cancellation or delay of grants affects current research capabilities and reduces the number of future startups, thereby hindering entrepreneurship growth within the affected ecosystems.

Why are federal funds essential for the success of tech and biomedical startups?

Federal funds are essential for tech and biomedical startups as they support research and development initiatives within universities. These funds allow for enhanced laboratory resources, attracting top talent and fostering environments where innovative ideas can turn into commercially viable companies, vital for the U.S. economy.

What are the long-term effects of cuts to research funding on the U.S. economy and innovation?

Cuts to research funding could lead to decreased innovation and entrepreneurship, resulting in a slowdown of economic growth. Over time, this may create a ripple effect where fewer startups emerge, leading to a less dynamic economy and a potential decline in the global competitiveness of U.S. industries.

How does research funding contribute to the entrepreneurial learning experience at Harvard?

Research funding enhances the entrepreneurial learning experience at Harvard by providing students access to cutting-edge projects and collaborations with faculty. This fosters an environment rich in knowledge and practical experience, equipping students with the tools needed to start their own companies and contribute to the startup ecosystem.

Can changes in research funding policy be reversed to support innovation and entrepreneurship growth?

Yes, changes in research funding policy can potentially be reversed, but the benefits may take time to materialize. It typically takes one to three years for research ideas to transition from lab to market; thus, ceasing funding disruptions will be necessary to restore innovation and entrepreneurship growth at research institutions.

| Key Points |

|---|

| Research funding is critical for innovation and economic growth in the U.S. |

| Harvard faces over $9 billion in funding scrutiny due to government actions. |

| Cuts to research funding can shrink GDP by 3.8%, comparable to the 2008-2009 recession. |

| Startups rely on research universities to commercialize scientific innovations. |

| Federal funding is essential for the development of tech and biomedical industries. |

| The impact of frozen NIH funding will take years to fully manifest. |

Summary

Research funding impact is significant, affecting both innovation and economic growth in the United States. The ongoing freeze of research funding, particularly at institutions like Harvard, poses a substantial risk to the future of biotechnology and technology startups. Without adequate funding, the traditional pathways that lead to successful startups — such as university research labs and entrepreneurial training — face potential collapse. This disruption could greatly diminish the pipeline for new companies and innovative solutions that drive economic advancement, signaling the urgent need for renewed investment in research funding.