Research funding is a vital lifeline for innovation, directly impacting the landscape of technology and entrepreneurship in the U.S. As federal research funding faces scrutiny and cuts, like those seen in the recent Harvard funding cuts, the potential repercussions extend far beyond academic circles. A significant reduction in funding not only threatens the output of groundbreaking scientific research but also stifles the growth of startups reliant on this critical financial support to turn their innovative ideas into market-ready solutions. The current climate poses substantial risks to the economic growth of the nation, which could shrink by a notable percentage if such trends continue. Understanding the impact of research funding is crucial for those invested in the future of the economy, the startup ecosystem, and the overall advancement of society.

Funding for scientific inquiries and innovation often serves as the cornerstone of economic progress and entrepreneurship. As research investment dwindles, it threatens to undermine the very foundations that support emerging enterprises and technological advancements. The disruption of financial flows intended for research institutions can severely hamper the development of new ideas and the launch of startups. These financial resources also serve as a catalyst for fostering a thriving entrepreneurial ecosystem, eventually translating into broader economic benefits. Hence, exploring alternative phrases such as “financial support for research” and “investment in innovation” helps to underscore the significance of these funds in fueling U.S. economic growth.

The Critical Role of Research Funding in Innovation

Research funding serves as the backbone of innovation, particularly in the science and technology sectors. When universities receive federal research funding, they have the resources to explore groundbreaking ideas that can lead to substantial advancements. These investments not only support the academic community but also translate into economic growth, as evidenced by studies that show for every dollar invested in biomedical research, there is a significant return in economic activity. Without this vital funding, the U.S. risks stagnation, as new discoveries that could enhance lives and drive markets are delayed or halted.

The broader impact of reduced research funding extends beyond just scientific inquiry; it creates a ripple effect that reverberates throughout the economy. Cutbacks at major institutions like Harvard can set off a chain reaction of losses in job opportunities and entrepreneurial activity. For instance, startups that rely on ideas generated within research labs can face a daunting future if those labs can’t engage in innovative research. The decline in federal funding correlates with a reduced capacity for universities to host aspiring entrepreneurs equipped with the training and resources necessary to launch successful ventures.

Effects of Research Funding Cuts on Startups

Startups are often the embodiment of innovation, translating new research into marketable products and services. The connection between research funding and the success of startups is profound; when funding is cut, the pipeline of ideas and talent that typically leads to entrepreneurial ventures diminishes. This is particularly relevant in settings like Harvard, where a significant number of students and faculty members are engaged in entrepreneurial endeavors that hinge on cutting-edge research. If funding is unavailable, these future business leaders may struggle to find inspiration or mentorship to turn their ideas into viable businesses.

Moreover, the ecosystem of support around startups—such as incubators, venture capital firms, and mentorship programs—thrives on the innovations emerging from research institutions. Without sufficient funding, universities may struggle to nurture their entrepreneurial talent effectively. As companies face challenges in innovation due to lack of access to resources, the startup landscape risks becoming less dynamic, leading to fewer job opportunities and, ultimately, slower economic growth. Over time, the potential threat to startups can significantly impact the overall economy, suggesting a cyclical relationship between funding, innovation, and entrepreneurship.

The Entrepreneurial Landscape Post-Funding Cuts

The entrepreneurial landscape is intricately linked to the availability of research funding, creating a vibrant ecosystem that can thrive on innovation. In universities like Harvard, where research facilities are abundant and intellectual capital is rich, cuts to funding can diminish the quality and quantity of startups emerging from these institutions. The cancellation of initiatives and halting of grant payments not only jeopardizes current research projects but also sends a message to potential entrepreneurs that resources are scarce and opportunities may be limited.

As the startups that arise from these environments begin to feel the pinch of funding cuts, the long-term repercussions on innovation can be grave. Startups require continuous influxes of ideas and support which are closely linked to the activities in research labs. Should the freeze continue, we could see a future where fewer innovative solutions enter the market, which may not only stall economic growth but also stifle the creativity that drives many of today’s technological advancements. Ultimately, understanding the interconnectedness of research funding and entrepreneurship is crucial for fostering a resilient economic framework.

Long-Term Impacts of Research Funding Freeze

As we assess the long-term impacts of the ongoing research funding freeze, the implications for U.S. innovation are concerning. While the immediate effects may not be overtly visible, the cumulative loss of research capacity can disrupt the entire ecosystem that fosters economic growth. The timeline for realizing the full impact can extend over several years, particularly as it takes time for research initiatives to lead to new commercial ventures. A lack of funding can delay critical scientific breakthroughs and innovation cycles, meaning the challenges faced today will be echoed in the economy for years to come.

Additionally, universities serve as incubators for the next generation of entrepreneurs. When funding is diminished, the pipeline of ideas, mentorship, and research collaboration suffers. This disconnect can lead to a brain drain where the best minds seek opportunities elsewhere, potentially undermining the future competitiveness of U.S. industries. Ensuring a robust system of research funding is crucial to sustaining a vibrant entrepreneurial landscape that is essential for maintaining economic strength and technological leadership.

Federal Research Funding and Economic Growth

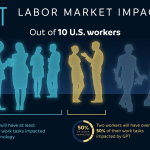

Federal research funding is a linchpin in the mechanism of U.S. economic growth, especially in the realms of technology and biomedical sciences. By securing these funds, research institutions can delve into high-impact projects that drive substantial economic returns. The correlation between federal investments in research and broader economic outcomes is clear; increased funding often leads to more jobs, technological advancement, and commercial products that enhance quality of life. Understanding the interplay between federal funding and its contributions to entrepreneurship and economic resilience is vital for policymakers and stakeholders alike.

A concerted effort to safeguard research funding can promote a thriving entrepreneurial ecosystem. When researchers can access the necessary resources, they are more likely to develop innovative solutions that can be converted into successful businesses. This not only bolsters job growth but also contributes to advancements in health care, technology, and multiple sectors that rely on cutting-edge research. For the U.S. economy to flourish in the face of global competition, ongoing support for federal research initiatives is imperative as it underpins the very foundation of innovation and entrepreneurship.

Navigating Funding Challenges in Higher Education

The challenges posed by funding cuts in higher education require strategic navigation by both institutions and policy makers. Universities must develop adaptive strategies to mitigate the impacts of these funding constraints while still maintaining their roles as innovation leaders. Engaging with private sector partners, alumni, and philanthropic organizations can provide alternative funding streams that safeguard the future of research and entrepreneurship initiatives. Such collaborations could lead to the development of robust support systems for researchers and entrepreneurs alike.

Additionally, addressing the concerns stemming from controversial funding reviews can pave the way for discussions regarding sustainable funding models. As universities face increasing scrutiny over their funding sources and research agendas, it becomes imperative that they emphasize the intrinsic value of their research contributions to society and the economy. Fostering transparent discussions around funding challenges may also yield innovative solutions that help sustain the entrepreneurial spirit crucial for future economic contributions.

The Impact of Harvard’s Funding Cuts on the Startup Ecosystem

Harvard’s recent funding cuts pose serious implications for its startup ecosystem. The university’s rich repository of research activities, which has historically fueled entrepreneurial ventures, is at risk as grants and resources dwindle. Startups thrive on the creative output from academic institutions, and with the freezing of over $9 billion in funding, there is a real danger that fewer innovative ideas will make it to market. As these funding cuts manifest, emerging startups may find it challenging to access the mentorship and educational resources necessary for their development.

Furthermore, the narrative around the potential of startups emerging from institutions like Harvard might shift dramatically. As federal funding becomes scarce, the likelihood of attracting top talent also diminishes, as students and faculty might opt for institutions offering more stable research funding environments. The absence of this talent can stifle the creativity and innovation that are essential for a vibrant startup scene. Therefore, understanding the cascading effects of such cuts on the startup ecosystem is essential for both institutional leaders and policymakers aiming to maintain America’s technological edge.

Recovering from Research Funding Disruptions

Recovering from funding disruptions is a challenging yet necessary endeavor for institutions and the broader economic landscape. The key lies in recognizing the long-term impact these cuts can have on the research-to-startup pipeline. To weather such storms, it is critical to develop comprehensive recovery strategies that include seeking new funding sources, expanding partnerships with private entities, and reinforcing alumni engagement to cultivate a new wave of support. Collaborative initiatives may also foster innovation and enhance resource-sharing among institutions facing similar funding challenges.

In addition, mitigating these disruptions calls for proactive communication with stakeholders in both the academic and business communities. By showcasing the importance of research funding in driving innovation, institutions can rally support and emphasize the critical role that continued funding plays in entrepreneurial success. Engaging in advocacy efforts to reverse unfavorable funding decisions and raise awareness about the economic consequences of research funding cuts can also contribute to the recovery process. The collective effort of all involved parties is vital to restore and enhance the foundation that supports U.S. innovation and economic vitality.

Understanding the Interplay Between Research Funding and Entrepreneurship

Understanding the intricate relationship between research funding and entrepreneurship is essential for fostering a flourishing economy. Research institutions not only produce novel ideas but also play a pivotal role in equipping the next generation of leaders with the necessary skills to turn these ideas into successful ventures. By prioritizing investment in research funding, policymakers can stimulate an environment in which entrepreneurship thrives, leading to job creation and societal improvements.

As economies face various pressures and challenges, leveraging research funding to bolster entrepreneurship becomes increasingly crucial. The connection between the quality of research and the potential for business innovation is undeniable, emphasizing the importance of maintaining robust funding channels. Proactive strategies that bolster both research funding and entrepreneurship initiatives are key to ensuring that the U.S. continues to lead in technological advancements and economic growth.

Frequently Asked Questions

What is the impact of research funding on U.S. economic growth?

Research funding plays a crucial role in driving innovation and economic growth in the United States. Every dollar invested in federal biomedical research is projected to generate $2.56 in economic activity, demonstrating how essential research funding is for stimulating the economy and supporting commercial enterprises.

How does federal research funding affect startups and entrepreneurship?

Federal research funding provides essential resources that empower universities and laboratories to develop innovative ideas that can lead to new startups. By fostering an environment rich in research, it attracts talented individuals and encourages the creation of new ventures, significantly contributing to the growth of entrepreneurship.

What are the consequences of Harvard funding cuts on startups?

Harvard funding cuts can have wide-ranging effects on startups, particularly those that rely on university resources for research and development. The freezing of over $2 billion in research grants may lead to fewer innovative projects being initiated, ultimately limiting the pipeline of new startups and innovations in the field.

Why is federal research funding critical for technology and biomedical industries?

Federal research funding provides the financial support necessary for labs to conduct pivotal research that drives the technology and biomedical industries. This funding helps create an attractive environment for aspiring entrepreneurs and researchers, enabling the formation of viable commercial enterprises.

How do funding freezes impact long-term research and development at universities?

Funding freezes can drastically disrupt the pipeline for research and development at universities, often leading to hiring freezes and canceled initiatives. As a result, the full effects may not be immediate, but over time, they could lead to a decline in promising startups and innovative solutions.

What are the critical roles of research universities in the startup ecosystem?

Research universities serve as vital incubators in the startup ecosystem by providing both the intellectual resources and a supportive culture for entrepreneurship. Faculty and students are instrumental in this process, leveraging lab research and entrepreneurship programs to foster the growth of new companies.

| Key Point | Details |

|---|---|

| Threat to Research Funding | Harvard has faced over $9 billion in funding reviews due to government demands, which has led to a freeze on $2 billion in grants. |

| Economic Impact | Projected GDP shrinkage of 3.8% as a result of research funding cuts, comparable to the Great Recession. |

| Startup Ecosystem | Research universities are critical for startups, providing pathways through faculty research and entrepreneurship curricula. |

| Role of Federal Funding | High-quality federal funding is essential for innovative ideas to evolve into successful commercial ventures. |

| Medium to Long-term Effects | The true impacts of funding cuts will be felt in the coming years, with fewer startups emerging from the system. |

Summary

Research funding is crucial for driving innovation and economic growth in the U.S. The ongoing crisis surrounding cuts to research funding at prestigious institutions like Harvard threatens not only the immediate flow of new ideas but also the long-term viability of the startup ecosystem that relies on university research. As funding freezes extend, entrepreneurs may struggle to access the resources they need to turn scientific breakthroughs into marketable products, ultimately stifling the very innovation that fuels economic expansion.