China tariffs are a pivotal topic as they have far-reaching implications for the global economy, particularly in the context of US-China trade relations. Historically, the imposition of tariffs has been used as a tool to manipulate trade dynamics, but these measures can lead to complex consequences that ripple through both nations’ economies. As tariffs increase, experts predict an impact on U.S. consumer prices, disrupt supply chains, and alter international trade interactions. The potential for a renewed trade war raises concerns not only for the China economy but also for diplomatic relationships that the U.S. has cultivated over decades. Understanding the nuances of China tariffs is essential for grasping the intricate tapestry of global commerce and the possible outcomes stemming from this ongoing economic tension.

The implementation of trade duties on Chinese goods represents a significant challenge within the sphere of international commerce, especially when considering the interconnectedness of global markets. These levies, often described as tariffs, are not merely economic tools; they also serve as instruments of geopolitical maneuvering, reflecting broader trade conflict narratives. The effects of such measures may extend beyond immediate economic repercussions, potentially reshaping strategic alliances and partnerships. As the trade landscape evolves, stakeholders must consider the ripple effects on both U.S. imports and the broader implications for international trade agreements. Therefore, analyzing these tariffs opens up discussions about the future of trade negotiations and the power dynamics between the U.S. and its global economic counterparts.

Understanding China Tariffs and Their Broader Impact

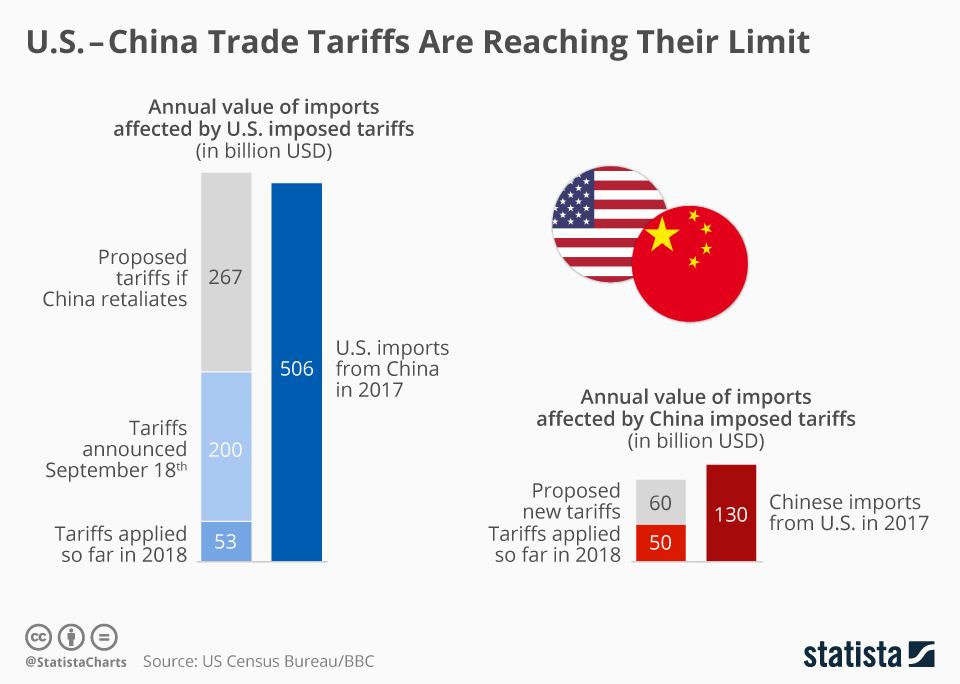

China tariffs have become a focal point in discussions regarding U.S.-China trade relations, especially following recent announcements related to potential tariff increases. The proposed 60 percent tariffs on Chinese imports could have severe ramifications for both the Chinese and U.S. economies. Economists warn that while these tariffs might aim to penalize China’s trade practices, the retaliatory responses could complicate American supply chains, leading to shortages and higher prices on consumer goods. The domino effect of increased costs can spread to various sectors, reinforcing the importance of understanding how tariffs function within the broader landscape of international trade.

Moreover, the impact of tariffs extends beyond immediate economic concerns. A trade war could destabilize relationships that the U.S. maintains with its allies. For instance, as tariffs push U.S. companies to seek alternative suppliers outside China, this dynamic can provide China with an opening to strengthen ties with other nations affected by U.S. import tariffs. The shift in trade relationships and alliances can have long-term consequences, affecting diplomacy, global market dynamics, and the overall power balance in international trade.

Consequences of the Ongoing Trade War

The ongoing trade war between the U.S. and China highlights the fragility of global supply chains and the interdependence of economies. As tariffs increase, companies may face steep costs related to sourcing materials and manufacturing goods, leading to higher prices for consumers in the U.S. Additionally, the impact of tariffs on the China economy could prompt Beijing to seek new markets to counterbalance lost trade with the U.S. This inclination to pivot towards other economic partnerships may lead to a further erosion of U.S.-China relations, as Beijing engages with traditional American allies, including countries in the EU, to shore up its economic standing.

Furthermore, the uncertainty surrounding the trade war creates an environment of unpredictability that can stifle innovation and investment. Businesses are likely to delay expansion plans or hesitate to invest in new technology due to the potential for abrupt changes in trade policies. This hesitance can ultimately stall advancements in critical industries such as technology and pharmaceuticals, which rely heavily on both U.S. and Chinese components. As a result, the ongoing trade tensions may yield not only immediate economic challenges but also long-term stagnation within competitive sectors.

China’s Strategies to Mitigate Tariff Impacts

In response to the potential imposition of high tariffs from the U.S., China has been developing strategies to mitigate these effects and maintain its economic momentum. One of the key aspects of their strategy is diversifying export markets beyond the U.S. By fostering trade relationships with emerging markets in Asia, Africa, and Latin America, China aims to reduce its reliance on the American market. This pivot can be seen in initiatives like the Belt and Road Initiative, which seeks to improve infrastructure and connectivity across regions, thereby enhancing China’s trade options.

Additionally, the Chinese government has been implementing fiscal stimulus measures to bolster its domestic consumption. By encouraging citizens to spend and invest within China rather than relying on exports, the government aims to cushion the economy against the shocks caused by U.S. tariffs. However, transitioning to a consumer-driven economy remains a challenging task as cultural and structural barriers exist. The delicate balance between sustaining exports while simultaneously nurturing the domestic market will determine how effectively China can weather the storm of increased tariffs.

Potential Shifts in Global Supply Chains

A pronounced increase in China tariffs is likely to trigger significant shifts within global supply chains. Many manufacturers that currently rely heavily on Chinese inputs may face disruptions as tariffs raise costs. In response, companies might rethink their sourcing strategies, seeking to establish operations in countries like Vietnam or India, which could fill the gap left by a diminished Chinese supply chain. However, the transition is not without its hurdles, as building robust supply chains in new countries that meet quality and speed standards is time-consuming.

Moreover, as businesses scramble to replace Chinese goods, it provides an opportunity for competitors from other regions to capitalize on the opening. However, sustaining the level of production and quality seen from Chinese manufacturers will be a challenge for countries attempting to step in. Therefore, while some regions could benefit from a decline in Chinese imports to the U.S., the complexity of logistics and established trade practices means that such transitions may prove lengthy and costly.

The Role of Indian and Vietnamese Markets

Countries like India and Vietnam present promising alternatives as potential beneficiaries of declining Chinese imports due to U.S. tariffs. Both countries have been actively improving their production capabilities and welcoming foreign investment with the aim of becoming integral parts of the global supply chain. These nations could take advantage of companies seeking to diversify their manufacturing options in the events of heightened tariffs, particularly in sectors like textiles, electronics, and increasingly, advanced manufacturing.

However, it is important to note that transitioning supply chains to these markets comes with inherent risks. India’s regulatory landscape and infrastructure challenges may impede rapid scaling, while Vietnam’s geographic proximity to China could expose it to similar disruptions. Despite these challenges, engagement with these markets holds the potential to alleviate some of the pressure caused by increased tariffs on Chinese imports.

Long-term Effects of Tariff Policies on U.S.-China Relations

Long-term effects of imposition of high tariffs are likely to exacerbate existing tensions in U.S.-China relations. As tariffs force companies to seek suppliers outside of China, Beijing might interpret such actions as a threat to its standing in the global market. This deteriorating relationship may lead to further retaliatory measures from China, which could result in an entrenched cycle of economic antagonism. The possibility of a prolonged trade conflict casts a shadow over any chances of effective diplomatic engagement and cooperation between the two nations, as nationalistic sentiments may rise in both countries.

Additionally, the emergence of trade barriers fosters an increasingly fragmented marketplace, which could result in inefficiencies that negatively impact both consumer choice and pricing. There is a risk that the U.S. economy could become isolated from critical technological advancements produced in China, limiting its competitiveness in the global arena. Therefore, the potential for tariffs to create lasting divisions between the two largest economies in the world underscores the need for dialogue and negotiation rather than punitive trade practices.

How Foreign Alliances Will Shift Under U.S. Tariff Strategy

With the initiation of sweeping China tariffs, the landscape of foreign alliances may undergo substantial reconfiguration. Countries affected by U.S. tariffs, such as Canada and Mexico, as well as traditional allies in Europe, might decide to strengthen their ties with China as a counterbalance. This repositioning could undermine U.S. influence across several global forums, altering the dynamics of international trade relations. Current discussions highlight that nations targeted by U.S. tariffs may become more amenable to Chinese overtures, leading to a realignment of trade preferences.

As the U.S. appears to adopt an isolationist trade policy, countries will likely be compelled to seek partnerships that enhance their own economic viability. This potential shift can open the door for China to assert its economic presence more aggressively while redefining its relationships with countries that command strategic importance. Such dynamics could lead to a notably different balance of power, significantly altering the traditional geopolitical alliances that have characterized the past several decades.

Navigating Economic Uncertainty: The Consumer’s Perspective

For American consumers, the potential for steep tariffs on Chinese goods prompts rightful concern regarding rising prices and diminished product availability. As companies are forced to absorb increased costs or pass them along to consumers, budgeting and spending habits will undoubtedly be affected. The uncertainty surrounding tariffs may lead to consumer trepidation, prompting individuals to postpone purchases or seek alternatives, which could create cascading effects across various sectors of the economy.

Moreover, as supply chain disruptions become more commonplace, the implications for product quality and availability will be significant. Consumers may find themselves facing longer lead times for essential products or finding substitutes that might not meet their expectations. The overall economic environment characterized by volatility emphasizes the need for American households to stay informed and adaptable as they navigate the changing landscape of goods resulting from evolving tariff policies.

The Future of Trade Relations: Seeking Diplomatic Solutions

As tariffs threaten to deepen mutual animosity, the urgent need for diplomatic dialogue becomes clearer. Both the U.S. and China stand to benefit from seeking resolutions that prioritize constructive engagement over punitive tariffs. Collaborative negotiations could pave the way for policies that address legitimate concerns about trade practices while also preventing the unintended consequences that hefty tariffs typically bring. This path forward could enhance global stability and restore confidence in international trade agreements.

Additionally, reinvigorating trade talks would signify a commitment to collaboration rather than confrontation, allowing room for compromises that could facilitate new trade frameworks benefitting both nations. Reducing tariffs may not only stabilize economic conditions but also restore trust between the two countries, setting a positive tone for future negotiations on broader issues, including technology transfers and intellectual property rights. Ultimately, achieving sustained peace in trade relations will demand foresight and tempered responses from leaders on both sides.

Frequently Asked Questions

What are the implications of China tariffs on US-China trade relations?

The implementation of China tariffs significantly affects US-China trade relations by increasing trade tensions and potentially provoking retaliation from China. These tariffs can raise the cost of imports, leading to higher prices for American consumers and disrupting established supply chains. The tariffs also risk pushing China to strengthen ties with other global powers, potentially altering the traditional dynamics of international trade.

How do China tariffs impact the US economy?

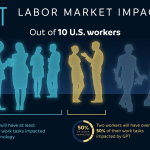

China tariffs impact the US economy by raising import costs, which can lead to inflation as prices for consumers increase. Additionally, tariffs can disrupt supply chains, causing delays in manufacturing and product availability. The tariffs might also result in job losses in industries reliant on imports from China, while simultaneously limiting the benefits derived from trade with one of the largest economies.

What are the potential consequences of a renewed trade war over China tariffs?

A renewed trade war involving China tariffs could lead to escalated tensions, retaliatory measures from China, and increased uncertainty in both economies. This scenario may drive investors away due to perceived risks, resulting in decreased economic growth and potential destabilization of global markets. Additionally, the trade war could hinder international cooperation and strengthen alliances that might oppose US interests.

How might China respond to high US import tariffs?

China may respond to high US import tariffs by imposing its own tariffs on American goods, thereby retaliating against US policies. This tit-for-tat approach is aimed at protecting China’s economy while signaling to other nations the challenges posed by US tariffs. Moreover, China might focus on diversifying its trade partnerships to reduce dependency on the US market.

What is the significance of tariffs on the Chinese economy?

Tariffs on Chinese goods are significant as they threaten a crucial revenue stream for the Chinese economy, which heavily relies on exports. High tariffs could exacerbate challenges already faced by China, such as weak consumer demand and a struggling housing market, while potentially driving some manufacturers to seek alternative markets in other regions of the world.

Can China adjust its economy to mitigate the effects of US tariffs?

China can attempt to adjust its economy by focusing on diversifying its export markets and enhancing domestic consumption. However, the significant reliance on the US market presents challenges, making it crucial for China to implement strategic policies to stimulate the domestic economy while fostering international trade relationships that expand beyond the United States.

What are the likely beneficiaries if US tariffs on China are increased?

Countries such as India and Vietnam may benefit if US tariffs on China increase, as they could attract investment aimed at filling the void left by Chinese exports. These nations have been developing their manufacturing capabilities and may find opportunities to serve as alternative suppliers for US markets, although this transition takes time and investment in infrastructure.

How might high US tariffs influence China’s international trade strategy?

High US tariffs could lead China to accelerate its international trade strategy by seeking to build and strengthen relationships with other countries. This may involve initiatives like the Belt and Road Initiative, aiming to create new markets and expand export opportunities, particularly in emerging economies and developing regions.

What is the role of China tariffs in the global supply chain?

China tariffs play a critical role in the global supply chain as they affect the flow of goods and components that are interconnected across various countries. Increased tariffs can lead to disruptions in supply chains, impacting industries worldwide, and prompting companies to reevaluate sourcing strategies in order to mitigate risks associated with reliance on Chinese manufacturing.

How do tariffs on Chinese imports affect American consumers?

Tariffs on Chinese imports affect American consumers primarily through increased prices. Consumers are likely to face higher costs for imported goods, including electronics and household items, as companies pass on the additional expenses from tariffs. This can also lead to reduced purchasing power and altered buying behavior among consumers.

| Key Points | Details |

|---|---|

| Impact of U.S. Tariffs on China | Imposing tariffs could hurt China’s economy but might also lead to higher prices and supply chain disruptions in the U.S. |

| Potential Backfire | New tariffs may weaken U.S.-China ties and offer China the chance to strengthen relationships with U.S. allies. |

| Economic Challenges | China is facing a weak housing market and low consumer demand, complicating its response to tariffs. |

| Need for Clarification | Ambiguity around tariffs could create uncertainty for China, particularly regarding rules of origin for goods. |

| Market Diversification | China is looking to explore new markets like Southeast Asia and Latin America through initiatives like the Belt and Road Initiative. |

| Long-term Strategy | China has been strategizing for potential tariffs and focusing on boosting domestic consumption. |

| Alternate Suppliers | India and Vietnam may benefit from reduced Chinese imports, but it will take time to develop their supply chains. |

| U.S. Tariff Policies | Broad tariffs might unite China and its traditional economic opponents, creating new alliances against the U.S. |

Summary

China tariffs could significantly reshape the U.S. economy and international relations. While intended to protect American interests, they risk backfiring by increasing consumer prices and encouraging supply chain disruptions. Moreover, tariffs may inadvertently empower China to strengthen its ties with U.S. allies, challenging America’s traditional trade networks. As U.S. leaders consider such measures, the broader implications for economic stability and foreign relationships warrant careful evaluation.