The potential for Trump Federal Reserve removal has stirred considerable debate among economists and political analysts alike. President Trump’s turbulent relationship with Federal Reserve Chairman Jerome Powell has been characterized by discord over monetary policy, interest rates, and the independence of the Fed. While Trump initially nominated Powell, his dissatisfaction with the Fed’s cautious approach to interest rates has led to speculation about the president’s desire to replace him before his term ends. Many observers warn that such a drastic move could undermine the Federal Reserve’s long-held independence, a cornerstone of successful monetary governance. As the market reacts to these uncertainties, the implications of a possible Trump ousting of Powell could resonate far beyond the Board of Governors, influencing global financial stability and investor confidence in U.S. economic policy.

The topic of Trump possibly dismissing the Federal Reserve chair raises significant questions about executive power and central bank autonomy. Discussions around the removal of Jerome Powell, who heads the institution responsible for regulating money supply and interest rates, reflect broader concerns regarding the inherent independence of the Federal Reserve. In an increasingly polarized political environment, the suggestion that a sitting president might seek to interfere with the appointment of the FOMC chair prompts crucial conversations about the boundaries of monetary policy and governance. Analysts emphasize that any abrupt changes in leadership at the Fed could shake market confidence and volatility, highlighting the fragile balance between political influence and economic stability. Thus, the discourse surrounding the potential termination of Fed leadership underscores the essential nature of an independent central bank in fostering sound economic policy.

The Implications of Trump Removing the Fed Chair

If President Trump were to go forward with the removal of Federal Reserve Chair Jerome Powell, the implications could be seismic for both the economy and the structure of the Federal Reserve. This move would not only raise questions about the independence of the Fed, a cornerstone of U.S. monetary policy, but it could also trigger volatility in financial markets. Economists and analysts agree that keeping a stable figure like Powell, who was confirmed in 2018 after Trump’s nomination, is essential for maintaining investor confidence. Removal might signal a tilt towards more aggressive monetary policies that favor short-term growth at the expense of long-term economic stability.

Moreover, such a significant leadership shake-up within the Federal Reserve can undermine the institution’s credibility. The Fed’s ability to control inflation depends heavily on its perceived independence from political pressures. Should Trump attempt to instill a leader who is more compliant with political objectives, this could result in a loss of market trust. Investors may fear a period of protracted uncertainty about monetary policy direction, leading to a rise in interest rates, which would further complicate economic recovery efforts.

Jerome Powell and Federal Reserve Independence

Jerome Powell’s tenure as the Federal Reserve chair has been characterized by a delicate balancing act between economic stability and political influence. His approach has aimed to uphold the independence of the Federal Reserve, which enables it to respond to economic fluctuations without succumbing to short-term political pressures. Critics of President Trump’s policies argue that any attempt to dismiss Powell could be viewed as an attack on this independence, a fundamental principle established to combat inflation and stabilize the economy.

The Federal Reserve’s autonomy is essential for maintaining a reliable monetary policy framework that is less susceptible to political whims. Should Trump engage in the removal of Powell, it could set a dangerous precedent, suggesting that leadership could be swayed based on political interests rather than economic judiciousness. This could lead to a re-evaluation of the structure of the Fed, perhaps compelling lawmakers to reconsider its operational governance and the manner in which Fed chairs are appointed.

Consequently, it is imperative that lawmakers and economists advocate for the preservation of the Federal Reserve’s independence. In a climate where political influence may threaten the integrity of economic decisions, ensuring that the Fed operates free from these influences is critical. Powell’s leadership, therefore, stands as a linchpin in the Federal Reserve’s endeavor to achieve stable economic growth without succumbing to political pressures.

Trump’s Interest in Manipulating Interest Rates

Throughout his presidency, Trump has often expressed frustration with Fed interest rate policies, believing they inhibit economic growth. His administration typically favored lower interest rates to stimulate borrowing and investment, essential for rapid economic recovery during his tenure. Trump’s critiques of Powell often centered on his calls for more aggressive rate cuts, which align with a looser monetary policy approach, something that has raised concerns among economists.

However, the intricacies of interest rate management extend beyond immediate economic interests. The Federal Reserve aims to modulate rates based on macroeconomic conditions to maintain inflation targets while fostering employment growth. Trump’s push to manipulate these rates to his favor can compromise the Fed’s primary mission and exacerbate fears of rising inflation. As such, interest rates must be managed with a long-term perspective to ensure sustainable economic health.

Market Reactions to Federal Reserve Changes

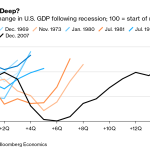

Market reactions to potential Federal Reserve changes often portray a clear narrative of volatility and uncertainty. Should Trump decide to remove Powell, one can anticipate swift and pronounced reactions from Wall Street. Analysts warn that any shifts in the Fed leadership could lead to increased risk aversion among investors, prompting them to seek safer assets amid fears of an unstable monetary framework. This ripple effect could drive bond yields higher, particularly on longer-term securities.

Investors closely monitor the Fed’s actions and statements regarding interest rates and overall monetary policy. Removing the chair can thus breed skepticism about the Fed’s future direction, leading to fluctuations in stock prices and investor sentiment. As demonstrated in previous instances, market confidence heavily relies on the Fed’s perceived independence and the consistency of its policies; hence, any disruption could shake the foundations of both domestic and international investment trust.

The Role of the FOMC in Monetary Policy Decision-Making

The Federal Open Market Committee (FOMC) plays a pivotal role in shaping U.S. monetary policy. Comprising the Federal Reserve chair and other members of the Board of Governors, the FOMC meets regularly to assess economic conditions and implement monetary policy decisions, including interest rate adjustments. With Jerome Powell at the helm, the FOMC has navigated a complex economic landscape, balancing inflation targets and employment goals.

However, the effectiveness of the FOMC hinges on its members’ consensus, allowing for diverse perspectives in decision-making. While Powell’s leadership is central, he does not unilaterally dictate policy. Instead, FOMC deliberations involve significant consultation to reach consensus before executing monetary policy strategies. This collaborative approach ensures that various economic indicators and expectations inform decisions, contributing to the Fed’s credibility and fostering greater stability within financial markets.

Legal Framework Surrounding Fed Chair Removal

The legal framework governing the removal of the Federal Reserve chair separates the powers of the presidency from the structure established by the Federal Reserve Act. According to the Act, while the President has the authority to appoint members to the Board of Governors, the removal of a sitting chair such as Jerome Powell faces significant barriers. Analysts contend that firing Powell without clear legal justification could lead to prolonged court battles and instill uncertainty in market activities.

The historical context surrounding this issue emphasizes the challenge of reconciling executive authority with the independence of regulatory bodies. With the Supreme Court’s recent decisions potentially eroding the protections granted to independent agencies, the discourse surrounding Trump’s ability to remove Powell remains heated. Legal experts argue that proceeding with such a move without transparent grounds could destabilize confidence in the regulatory framework and threaten the credibility of the Federal Reserve.

Potential Successors to Jerome Powell

In the event that Powell is removed, speculation regarding potential successors is bound to arise. Investors and analysts alike will scrutinize the qualifications and leanings of any new candidate, with the expectation that the Fed’s commitment to stable inflation and economic growth remains intact. A successor with a strong record on monetary policy could help soothe market anxieties, provided they uphold the ideals of independence the Fed is built upon.

However, irrespective of the qualifications of a potential appointee, the very act of replacing Powell could signal a shift toward a more politically aligned monetary policy. Markets may interpret this change as a departure from the Fed’s traditional role, igniting fears of instability and leading to adverse market reactions. Therefore, the character and vision of Powell’s successor will undoubtedly play a critical role in restoring confidence in the Fed following such a tumultuous leadership transition.

Long-term Effects of Political Interference in the Fed

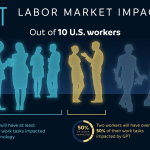

Political interference in the Federal Reserve’s operations can yield detrimental long-term consequences for the U.S. economy. Efforts to influence monetary policy may diminish the Fed’s ability to fight inflation, as trust in its independence wanes. The historical precedent shows that maintaining a clear separation between political motives and monetary policy is essential for long-term economic stability, as consistent and credible policy frameworks foster investor confidence.

In an era characterized by heightened political polarization, the stakes surrounding the Fed’s governance are at an all-time high. Should Trump’s administration attempt to wrest control of the Fed, it may open the floodgates for future administrations to use the institution as a political tool—eroding the fundamental responsibilities it has historically upheld. The long-term viability of American economic stability depends on such institutions operating free from day-to-day political pressures, enabling them to address complex economic challenges effectively.

The Future of Fed Policy Under Trump’s Administration

As the Trump administration continues to navigate its final turn, discussions surrounding the future direction of Federal Reserve policy are increasingly paramount. The challenges presented by prior economic decisions provide a reminder that the Fed must balance immediate political pressure with the need to maintain sustainable monetary practices. Powell’s leadership has primarily focused on assessing economic data to guide decision-making, ensuring that policies remain consistent with the Fed’s dual mandate of promoting maximum employment and stable prices.

Yet, with ongoing political pressures and an uncertain economic environment, the future of the Fed under Trump’s administration remains precarious. Investors are left to consider how Fed policies will adapt amid the looming uncertainty surrounding the possibility of Powell’s removal. Such circumstances demand vigilance from market participants, who must remain alert to signaling from the Fed as they navigate a landscape fraught with potential political implications.

Frequently Asked Questions

Can Trump fire Jerome Powell as the Federal Reserve Chair?

While President Trump has expressed frustrations with Federal Reserve Chair Jerome Powell, firing the Fed chair is legally ambiguous. The Federal Reserve Act does not explicitly provide for the chair’s removal except ‘for cause,’ which could involve complex legal interpretations. Trump’s threat to remove Powell raises concerns about undermining Federal Reserve independence and could have significant market implications.

What would happen to Federal Reserve independence if Trump removed Powell?

If President Trump were to remove Jerome Powell, it could severely impact Federal Reserve independence, which is essential for maintaining trust in the monetary policy framework. Such an action might signal to the markets that future monetary decisions could be politically influenced, leading to volatility and increased long-term interest rates.

How do Trump’s policies affect Federal Reserve monetary policy decisions?

Trump’s tenure has introduced significant pressure on the Federal Reserve, particularly regarding interest rate cuts. His view is that lower interest rates are necessary to stimulate swift economic growth. However, this can conflict with the Fed’s goal to manage inflation and maintain economic stability, illustrating a tension between presidential policies and Federal Reserve independence.

What are the legal grounds for Trump to remove Powell from the Federal Reserve?

Under the Federal Reserve Act, members of the Board of Governors can be removed ‘for cause.’ However, it’s unclear if this applies to the FOMC chair, as the chair’s role has a unique status. The Supreme Court’s interpretation of the president’s removal power regarding independent agencies poses further complexities.

Why is Wall Street concerned about Trump potentially ousting Powell?

Wall Street is apprehensive about the prospect of Trump removing Powell due to fears that it would compromise the Federal Reserve’s independence and credibility. Investors worry that such a move would lead to a looser monetary policy that could drive inflation, resulting in rising long-term interest rates and decreased confidence in the stability of economic prospects.

How could Trump’s relationship with the Fed impact interest rates?

Trump’s contentious relationship with Powell and the Federal Reserve may influence interest rates significantly. If financial markets perceive that the Fed will be pressured to adopt a more accommodative monetary policy, it could lead to fluctuations in interest rates, particularly longer-term rates, as investors react to perceived risks of inflation.

What is the significance of Powell’s term for Trump’s policies?

Jerome Powell’s term as Federal Reserve Chair is significant for Trump, as it provides an opportunity for Trump to influence monetary policy. However, considering that Powell’s term is approaching its end, many argue it would be more prudent for Trump to allow Powell to serve his term and nominate a successor aligned with his economic vision to avoid market disruptions.

How do potential changes in Fed leadership affect financial markets?

Changes in Federal Reserve leadership can cause market tremors due to uncertainty about future monetary policy. If Trump were to make a change, markets would scrutinize the motives behind the replacement. Powell’s removal might suggest a shift towards a more expansionary monetary policy, prompting concerns over inflation and leading investors to demand a higher premium for government bonds.

What are the implications for Trump’s interest rates if Powell is replaced?

If Trump replaces Powell with someone more amenable to aggressive monetary easing, it could initially lower interest rates to stimulate growth. However, this may lead to long-term inflation fears, prompting the market to adjust by raising long-term interest rates, which could counteract the intended economic stimulation.

Why is it vital for the Fed to maintain its independence from political influence?

Maintaining independence is essential for the Federal Reserve to effectively manage inflation and foster economic stability. If the Fed is perceived as subject to political pressures, its credibility diminishes, leading to uncertainty in financial markets, complicating economic recovery, and undermining the effectiveness of its monetary policy.

| Key Points | Details |

|---|---|

| Can Trump fire Fed chairman? | Trump has hinted at firing Powell due to disagreements over monetary policy. |

| Legal Interpretation | It remains unclear if the president can remove the chair considering the Federal Reserve Act allows removal for cause. |

| Impact on Markets | Firing Powell could destabilize markets due to fears over monetary policy changes. |

| Supreme Court Considerations | The Supreme Court’s views on executive authority may influence the potential for Powell’s removal. |

| Independence of the Fed | Trump’s possible actions could undermine the long-standing independence of the Federal Reserve. |

| Challenges of Removal | Significant market backlash could deter Trump from attempting to remove Powell. |

| Public Perception | Many believe that the Fed chair is more influential than he often is in practice. |

Summary

Trump Federal Reserve Removal remains a contentious topic as President Trump expresses his frustration with Fed Chairman Jerome Powell. The discussion around his potential ousting highlights issues of statutory interpretation, market response, and the independence of the Federal Reserve. Concerns about inflation and the economic impact of Trump’s policies exacerbate the situation, making removal a complicated and potentially detrimental decision. Ultimately, the interplay between presidential authority and market stability plays a crucial role in shaping the future of the Federal Reserve’s leadership.