The U.S. economy recession is a looming concern as recent developments suggest a potential downturn. A confluence of factors, including the ongoing trade war effects, stock market uncertainties, and shifting consumer sentiment changes, has placed substantial pressure on American financial markets. Tariff impacts from President Donald Trump’s policies have exacerbated fears among investors, leading to losses across various sectors. As the Federal Reserve faces critical interest rate decisions this week, there is an urgent need to address the implications of these fluctuations on economic stability. With rising concerns about a recession, understanding the underlying dynamics becomes imperative as they influence both short-term market performance and long-term growth prospects.

The looming threat of an economic downturn in the United States is gathering attention, as indicators such as declining consumer confidence and market volatility raise alarm. Analysts are increasingly worried about the repercussions of ongoing trade conflicts, inconsistencies in the stock market, and their effects on the overall financial landscape. The repercussions of tariffs implemented by the current administration could severely hinder economic growth, making it crucial for policymakers to assess the broader implications. As stakeholders await the Federal Reserve’s next moves concerning interest rates, the conversation shifts towards developing strategies to mitigate the risks associated with a potential recession. Ensuring a stable economic environment in the face of these challenges is vital for recovery and resilience.

Understanding the U.S. Economy and Recession Risks

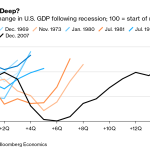

The U.S. economy is facing significant challenges that raise concerns about a potential recession in the near future. With consumer sentiment at its lowest since late 2022, many analysts argue that the signs of economic instability are becoming increasingly evident. Factors such as the ongoing trade war have created uncertainty that is palpable in the stock market, where fluctuations and heavy losses have triggered alarm among investors. These conditions, when compounded with diminishing consumer confidence, suggest that a recession could be on the horizon if these trends continue.

Moreover, the Federal Reserve’s upcoming interest rate decisions will be crucial in addressing these economic challenges. As the Fed grapples with balancing the necessity for growth against controlling inflation, the implications of tariffs and unstable trade relationships could further complicate their decisions. If rates remain elevated, it could curtail economic activity, slowing down job growth and potentially deepening the recessionary cycle. Thus, monitoring these dynamics is essential to understanding the future path of the U.S. economy.

The Impact of Trade Wars on Economic Stability

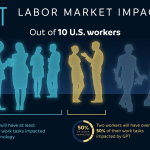

Trade wars, particularly between major economies like the U.S. and China, can wreak havoc on economic stability. The imposition of tariffs results in increased prices for consumers and reduced demand for goods, leading to a drop in consumption. As American businesses face higher costs due to tariffs on imported materials, they may also be compelled to reduce their labor force or delay capital investments, both of which can further exacerbate the economic downturn. This interconnectedness of global supply chains means that the effects of tariffs are not limited to a single sector; rather, they resonate through various industries, diminishing growth prospects.

Investors closely monitor trade developments as a barometer for economic health. Evolving trade policies can trigger immediate reactions in the stock market, where uncertainty reigns supreme. A protracted trade war may not only increase operational costs for businesses but could substantially dampen investor confidence. As perceived risks heighten, liquidity may dry up as companies shift into a retrenchment strategy, thus freezing hiring and stunting economic growth. In this context, the trade war’s ramifications extend far beyond immediate tariffs, influencing broader economic sentiment and the likelihood of recession.

Stock Market Uncertainties and Consumer Sentiment Changes

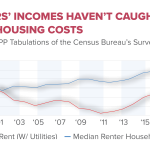

Recent stock market uncertainties are closely linked with shifting consumer sentiment, forming a cyclical relationship that can accelerate economic troubles. As the stock market experiences volatility, consumers often react by tightening their spending habits in anticipation of economic downturns. This behavior is particularly evident in the context of recent losses in the markets triggered by fears surrounding a trade war. A decrease in consumer spending can further strain businesses and amplify recessionary signals, creating a feedback loop that is difficult to escape.

Consumer sentiment reflects broader economic perceptions, and when confidence dips, it tends to result in reduced economic activity. The University of Michigan’s latest index findings underscore this phenomenon, highlighting a concerning trend of deteriorating confidence amongst consumers. This decline can lead to a slowdown in retail sales and investments, contributing to the likelihood of recession as businesses and consumers alike pull back from expansion and spending. Thus, understanding the interplay between the stock market and consumer sentiment can provide valuable insights into the potential trajectory of the U.S. economy.

Interest Rate Decisions in a Volatile Economic Climate

In light of potential recession risks, the Federal Reserve faces critical decisions regarding interest rates that could significantly influence the direction of the economy. The current economic climate, marked by uncertainties brought on by trade policies and market performance, adds complexity to the Fed’s approach. Should the Fed consider cutting rates to stimulate borrowing and spending, they must also weigh the potential inflationary pressures that result from such actions. Thus, it’s a delicate balancing act between fostering growth and controlling inflation amidst a backdrop of economic turbulence.

Additionally, the consequences of interest rate decisions extend well beyond monetary policy; they have profound implications for consumer behavior and business investment strategies. For example, if rates are maintained or increased, borrowing costs would rise, which might further dampen consumer sentiment—a cycle that could lead to reduced economic growth. Conversely, significant rate cuts could encourage spending but may also risk igniting inflation if the underlying economic adjustments, compounded by tariff impacts, are not properly managed. Therefore, the Fed must navigate these waters carefully in an effort to mitigate potential recessionary impacts.

The Tariff Impacts on American Manufacturing and Job Growth

The introduction of tariffs has far-reaching implications for American manufacturing and job growth, with many sectors grappling with the challenges posed by increased costs. While the intent of tariff policies may be to protect domestic industries from foreign competition, they often result in higher prices for consumers and strain on businesses reliant on imported goods. Consequently, American manufacturers may face reduced profit margins, leading to potential layoffs or diminished hiring efforts as companies adjust to a new economic reality under tariff impacts.

Moreover, the long-term viability of jobs in affected sectors remains uncertain as businesses reassess their strategies in response to tariff-induced instability. In sectors such as steel and aluminum, tariff protections initially aimed at helping these industries have had mixed results, with some firms struggling to adapt and others thriving. This dichotomy raises critical questions about the effectiveness of tariffs in boosting long-term job security in manufacturing versus the immediate adverse impacts felt across the economy. As the trade war escalates, understanding its implications for job growth remains pivotal for policymakers and economists alike.

Investor Reactions to Economic Uncertainty and Recession Predictions

Investor reactions to economic uncertainty can amplify existing market volatilities, leading to rapid shifts in stock prices as fears of a recession loom. As news about tariffs and trade policies proliferate, investors often respond by re-evaluating their portfolios, leading to sell-offs or reallocations in anticipation of market downturns. Such behavior can create a self-fulfilling prophecy, wherein investor anxiety contributes to the very economic difficulties they fear. Understanding these dynamics is essential for interpreting market movements within the broader context of economic health.

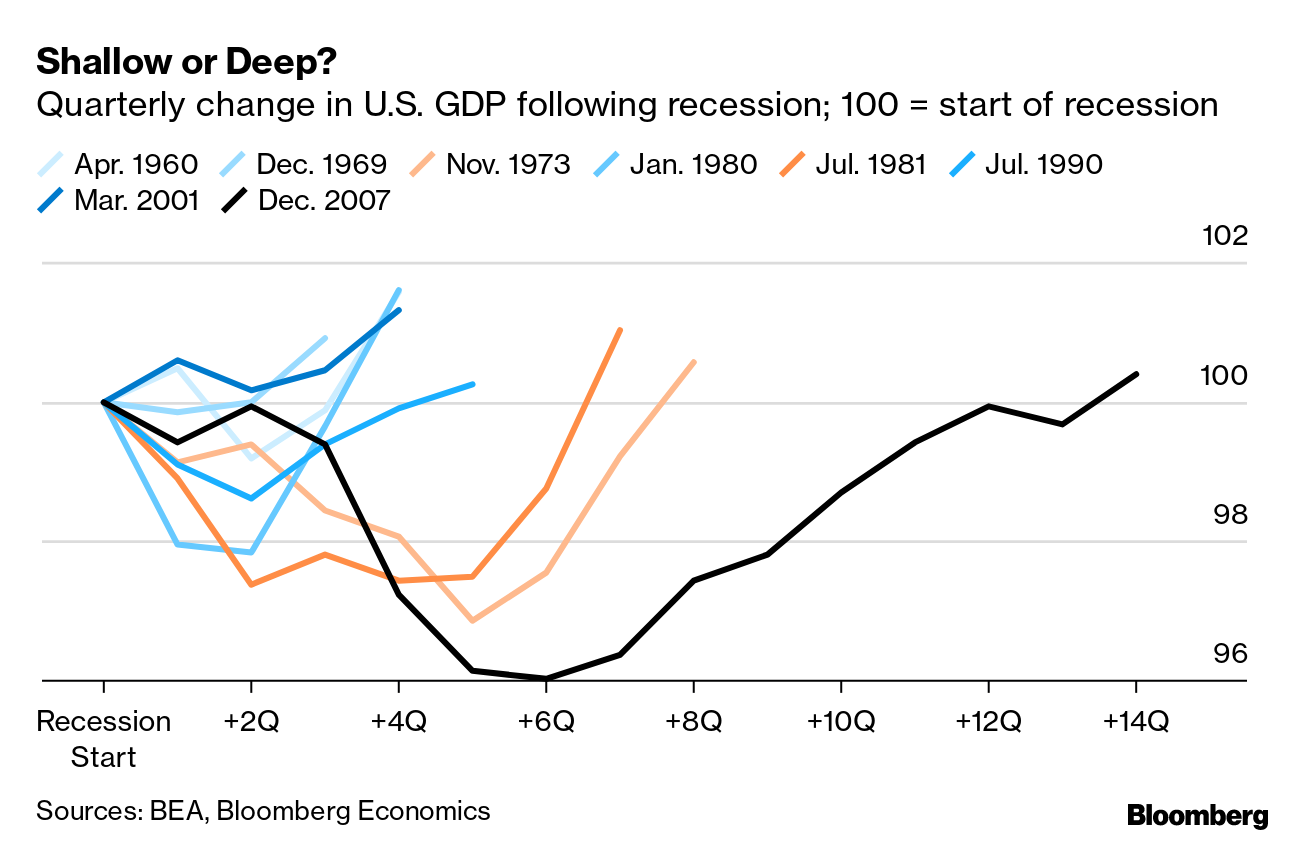

Amidst these uncertainties, predictions of a looming recession have led financial analysts and economists to closely monitor key indicators, including unemployment figures, GDP growth, and consumer spending patterns. This heightened vigilance seeks to identify early warning signs that could signal an impending downturn. Should market behaviors continue in a cautious direction, it may prompt additional Fed intervention or shifts in government policy aimed at stabilizing investor confidence. A transparent understanding of these reactions can foster better preparedness amidst an evolving economic landscape, safeguarding against deeper recessions.

The Role of Consumer Confidence in Economic Recovery

Consumer confidence serves as a critical driver for economic recovery, especially in times of uncertainty. When consumers feel optimistic about the future, they are more likely to spend, invest, and contribute to overall economic growth. Conversely, a decline in confidence—such as that reflected in the University of Michigan Index—can lead to reduced consumption, compounding economic slowdowns and deepening recessionary pressures. The interplay of consumer confidence and economic policies must be carefully managed to ensure sustainable recovery.

In light of current economic challenges, restoring consumer confidence is paramount for stimulating growth. Policymakers must navigate the sentiments shaped by trade wars and their effects on prices and job security. Initiatives aimed at reassuring consumers about economic stability, job security, and future growth prospects become critical. If consumers regain confidence, they could reinvigorate the economy, pull spending back off the sidelines, thus lessening the risk of recession and fostering an environment conducive to recovery.

Navigating the Complexities of Tariffs and International Trade

The complexities of tariffs and international trade in the current U.S. economic environment necessitate careful analysis and strategic navigation by both policymakers and investors. Tariffs remain a contentious topic, with stark polarized views on their immediate and long-term impacts. Understanding how trade policies affect not just domestic production but also international relationships is crucial for anticipating shifts in the economic landscape. As countries retaliate with their tariffs, the repercussions can create broader uncertainties, impacting global supply chains and magnifying recession risks.

Moreover, effective communication regarding trade policies becomes essential in maintaining economic stability. Clarity around tariffs can help businesses make better-informed decisions, reducing anxiety surrounding operational costs. If uncertainty around these policies lingers, it could exacerbate already heightened investor wariness and consumer doubt. Developing a comprehensive strategy that addresses both the domestic and international implications of trade can provide a pathway for minimizing recessionary impacts while fostering healthy economic relations.

Future Outlook for the U.S. Economy Amidst Uncertainty

Looking ahead, the future of the U.S. economy amidst prevailing uncertainties remains tenuous. With risks of a recession looming, various indicators like trade tensions and consumer sentiment point to a potentially unstable economic environment. Policymakers, economists, and investors alike must remain vigilant in monitoring developments, as intervention may be necessary to mitigate these risks. A proactive approach can pave the way for long-term resilience while recognizing that dealing with these uncertainties will require adaptive strategies.

As the narrative unfolds, understanding the myriad factors at play—from tariffs and stock market fluctuations to consumer confidence shifts—will be essential in shaping an informed outlook. The balance between stimulating growth and managing inflation remains delicate, necessitating nuanced policies and sound economic planning. By fostering collaboration across sectors and promoting transparency in policy communications, the U.S. economy can have a roadmap that leads toward sustained recovery and growth despite the complications of trade wars and potential recessionary fallout.

Frequently Asked Questions

What are the potential impacts of the ongoing U.S. economy recession on consumer sentiment changes?

As the U.S. economy recession deepens, consumer sentiment tends to decline significantly. Lower economic confidence results in reduced spending, which can further exacerbate recessionary pressures. Consumers may become more cautious about their purchases due to fears of job loss or declining income, creating a negative feedback loop that can prolong or deepen the recession.

How does the trade war affect the likelihood of a U.S. economy recession?

The ongoing trade war increases uncertainty in the U.S. economy, leading to a potential recession. Tariffs imposed on imports can raise costs for businesses, forcing them to either cut jobs or increase prices for consumers. This higher cost of living can dampen consumer spending, contributing to a slowdown in economic activity and eventually pushing the economy into recession.

What role do interest rate decisions play in trying to mitigate a U.S. economy recession?

Interest rate decisions by the Federal Reserve are crucial during a U.S. economy recession. By lowering interest rates, the Fed aims to stimulate borrowing and spending, which can help revive the economy. However, if inflation is also a concern, maintaining higher interest rates may be necessary to prevent further economic instability, creating a challenging balancing act for policymakers.

How might stock market uncertainties contribute to a U.S. economy recession?

Stock market uncertainties can significantly contribute to a U.S. economy recession by eroding consumer and business confidence. When the market fluctuates wildly or declines sharply, investors become wary, leading to reduced spending and investment. This drop in confidence can trigger a broader economic downturn as companies may delay hiring or expansion plans, further stalling economic growth.

What are the tariff impacts on the U.S. economy during a recession?

During a recession, tariff impacts can be particularly detrimental to the U.S. economy. Increased tariffs raise prices on imported goods, reducing consumer purchasing power and contributing to inflation. This can suppress demand, leading to decreased business revenues and potential layoffs, creating a vicious cycle that deepens the recession.

| Key Points |

|---|

| Heavy losses in U.S. markets due to tariffs imposed by China, Mexico, and Canada in response to U.S. tariff policies. |

| Concerns about a potential recession owing to a prolonged trade war and a decrease in consumer sentiment. |

| Economist Jeffrey Frankel warns against tariffs as they are generally harmful to the economy. |

| U.S. economy showing signs of instability with consumer confidence at its lowest since late 2022. |

| The Federal Reserve faces a dilemma between cutting interest rates to stimulate growth or maintaining rates to control inflation. |

Summary

The U.S. economy recession is becoming an increasingly pressing concern as uncertainties from trade wars and declining consumer sentiment loom large. Recent developments indicate that not only are markets responding negatively to tariff implementations, but forecasts for economic growth are also dimming. As risk perceptions rise among investors, the possibility of a recession intensifies, underscoring the need for strategic policy responses to navigate these turbulent times.